This is part 1 of 4 parts, as outlined below. Each subsequent part will be released separately at a later date. IF you wish to inquire about the next release, email mserwetz@gmail.com

(The article under separate cover is translated into Simplified Chinese) Link to Chinese Translation

I. The situation for Chinese textile/apparel exporters in 2023 and why it is what it is. What is the current textile and apparel situation in China?

II. Who is W. Edwards Deming and what did he tell the Japanese in 1950?

III. What needs to change in China to rebuild China’s reputation, respect and business?

IV. If not, will there be a Reckoning for China textile and apparel like there was for the US Auto Industry?

Article Abstract: Textile and Apparel business in China is suffering badly. Some or all of the following factors can be held responsible: 1. Political relations and the continuing Tariffs; 2. China’s reputation for cheap and poor quality product which is, at least partially, justified by evidence; 3. Sluggish domestic demand due to the lockdown and poor economy in China; 4. Due to some or all of the above, significant resourcing to alternative countries such as Vietnam.

In this article, we suggest that the only long-term solution for China is to rebuild its reputation for quality product and fashion innovation, just as Japan did in the 1950’s using the lessons of W. Edwards Deming’s teachings as a platform. Combined with this, China factories need to build their own brands which a. don’t scream Cheap and b. stand up to other international brands in style and quality.

But, China factory owners are resisting change, starting to panic and are lost for any solution except to find someone who may sell their product for commission. But, what would they be selling other than “Cheap China?”

Finally, we predict that, if some factories don’t lead the way to a new direction for China, the Chinese textile industry will crash and burn or, at best, be relegated to the mass market in such outlets as TJ Maxx and Walmart. Part of this is due to the bifurcation and consolidation of the US retail economy: The middle level department store base is disappearing, leaving only either competition for the mass market at rock-bottom prices or premium and luxury brands sold DTC or on platforms like Net-A-Porter and FarFetch. In addition, many new and innovative brands are appearing almost daily. The only Chinese online alternatives to those platforms are SHEIN and TEMU, which are by nature cheap and poor quality, and the innovative Chinese brands are rarely seen by overseas customers.

The Chinese textile industry will have to have a Reckoning, just as the American auto industry did in the 1970s and 1980s (as described by David Halberstam in his Pulitzer Prize-winning 1986 book): The world has changed; the way you did things and the things you got away with in the past are gone. If you don’t face the reality of the world today, you will also be gone.

I. The situation for Chinese textile/apparel exporters in 2023 and why it is what it is. What is the current textile and apparel situation in China?

The China textile and apparel business is in trouble. After more than 20 years, since China was admitted into the WTO and quotas were abolished, there isn’t room for one more manufacturer to do business with US customers and export their product, getting rich (comparatively or really) in the process. Here is a peasant economy that was transformed almost overnight into a global powerhouse, ascending to the #1 position as the world’s factory. Just open a factory, sell something (it doesn’t have to be great), and you will have lots of customers.

Led by Walmart, who buys 70-80% of their product from China, immense volumes of cheap goods filled American stores and sold on websites. Department stores like Macy’s ran to China to get into the cheaper-than-thou game, rather than stick to their middle-class roots. So, in what seemed like the blink of an eye, everybody wanted to buy shit from China (that word used qualitatively). What happened on the consumer side was, confronted by a sea of cheap shit everywhere, the average consumer (not just the struggling ones who needed to buy cheap) flipped their value proposition from price is determined by value to value is determined by price.

Let’s look at the numbers, which we will say up front are deceiving:

For 2021, according to the US Department of Commerce report:

“In 2021, China remained the major source of U.S. imports of Textile Products. In 2021, U.S. imports of $50.3 billion of Textile Products from China constituted 32.6% of the total U.S. imports of Textile products.”

And 2022:

“In 2022, China remained a major source of U.S. imports of Textile Products. U.S. imports increased by 6.7% ($3.4 billion) from $50.3 billion in 2021 to $53.7 billion, constituting 29.7% of the total U.S. imports of those commodities.”

All good, right? We see several issues: 1. 2022 was the first non-pandemic year so it stands to reason imports should go up (they were $538 billion in 2018 so overall they were just reaching pre-pandemic levels; 2. Had China had the same piece of US imports in 2022, it would have had $1.1 billion more business; 3. Based on the numbers given, US imports of those commodities increased 18.2 percent from 2021 to 2022, so China’s increase was indeed a smaller piece of the pie; 4. These numbers reflect what was received in 2022, so based on the planning cycle of 4-6 months, much of the goods were ordered in 2021.

Any way you look at it, despite the increase, there is a clear erosion of textile and apparel imports from 2021 to 2022. Orders received in 2022 and delivered in 2023 will show a further erosion.

Here’s the worst part: Clearly China factories are shipping goods just to ship goods and are sacrificing price and profit. Take a look at this:

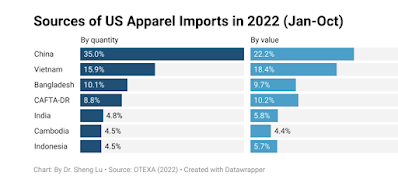

Apparel Imports from China were 35% of the quantity but only 22.2% of the value. On the other hand, imports from Vietnam were 15.9% of the quantity and 18.4% of the value. What does that mean to you? Cheap China is getting cheaper while Vietnam is commanding higher prices.

Now, we should have an idea of what is happening in the textile and apparel sector from China and why Chinese manufacturers feel lost and desperate. This will only get worse.

So the question if you are Chinese manufacturer is (or should be), “What should I do?” It is clear that the definition of insanity applies here: trying to do something the same way twice and expecting different results. China and China’s economy needs different results, especially in the textile and apparel industry. The 10% of imports from China that apparel and textile represents cannot erode without significant effect on the economy and employment. We can guarantee that, based on clearly established patterns of the industry (not just in China) that the workers will bear the brunt of any reduction; the owners are not giving back anything from their bank accounts.

Finally, weak economic growth and disruption in China has a significant effect on the world economy.

The rest of this article will build a case for a sea change in China’s apparel and textile industry, the same sea change that Japan made to transform the tagline of “Made in Japan” from cheap to one of the world’s best.

Those who read this and know China will wonder whether the culture and experience since Deng Xiao Ping declared that some people should get rich first is so embedded at this point that it minimizes or eliminates the possibility of positive change. We believe it can happen, led by the younger generation, the sons and daughters of the people who got rich first and the easy way. But it won’t happen until the older generation steps aside AND the government lets it happen.

Next, we take a look at what happened starting in 1950 Japan, led by W. Edwards Deming, which led to Japan’s current position on the world’s quality product scale. THIS is the example China should follow.